Started in 2017, Acko has rapidly evolved from a motor insurance provider to a key player in the health insurance sector. This article explores Acko’s journey, its strategic shift towards health insurance, and its recent moves to build a comprehensive health and wellness ecosystem for its customers.

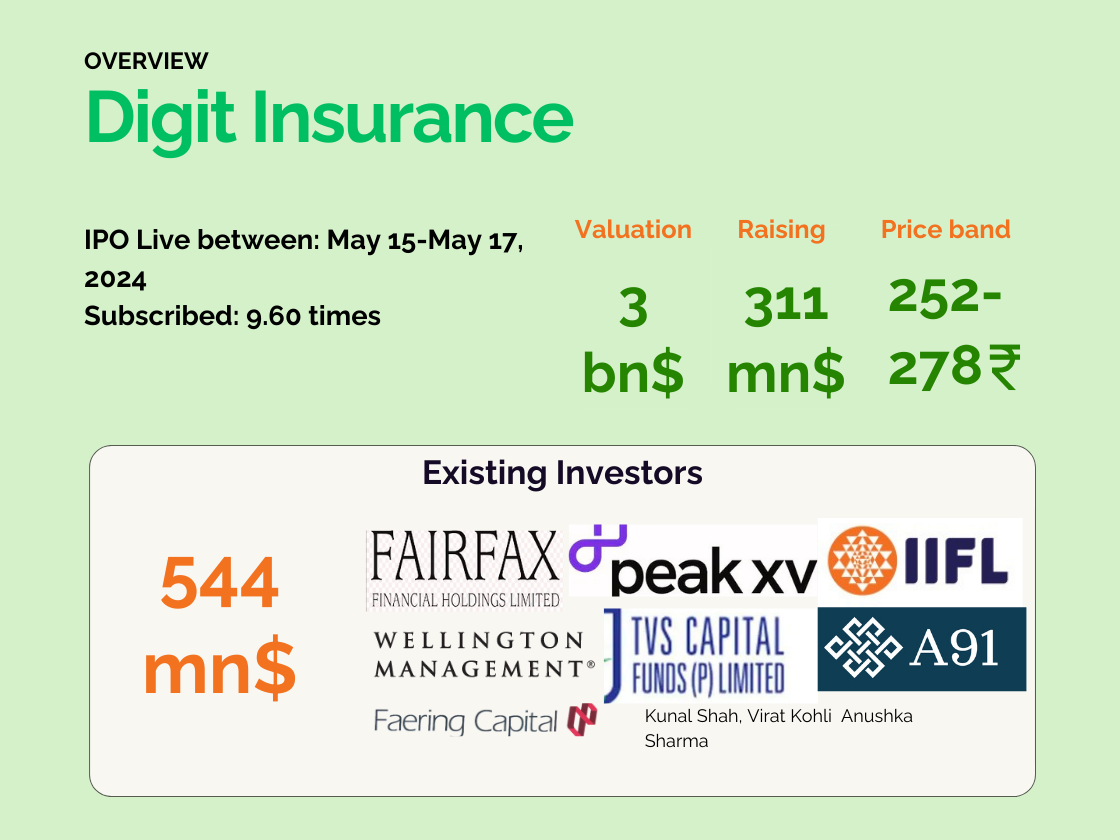

Acko and Digit are two insurtech torchbearers in India, challenging incumbents by integrating technology into traditional and customer-facing processes. Acko is backed by General Atlantic (10.7% equity) and other major foreign insurers and VCs, including, Swiss Re, Munich Re, Accel, Elevation Capital etc. The insurer is valued at 1.2bn$ (December, 2023) and has raised a total funding of 598mn$.

Acko’s Financials and Growth in FY24

Acko recorded a revenue of 2,106 Cr INR, representing a 19.8% increase from 1,758Cr INR in FY23. The revenue was driven by a Gross Written Premium (GWP) of 1,587Cr INR (73.35% of total income). Despite this growth, Acko continues to operate at a loss, reporting losses of 670Cr INR, although this was a 9.3% reduction from the previous year’s loss of 738.5Cr INR. The company’s total expenditure rose to 2,830Cr INR crore in FY24 from 2,535Cr INR in FY23.

Acko’s co-founder and CEO, Varun Dua, has expressed confidence in the company’s future, stating that Acko is on track to become profitable by FY 2027. This aligns with their strategic focus on expanding presence in the health insurance market and improving operational efficiency.

Acko’s Growing Presence in Health Insurance

Since its inception, Acko made its name prominent in the motor insurance space. However, looking at the Gross Direct Premium (GDP) data released by the IRDAI for FY23-24, we see an increasing interest of Acko in the health insurance market. Of the total GDP, health insurance and more specifically group health leads the premium pool with 809Cr INR, a total of 43% share in the total premium earned. Motor TP & Motor OD are the 2nd and 3rd largest contributor to the premium split. Health retail however, forms only a small part of the GDP in FY23-24 (2.35%).

Acko’s health insurance portfolio has demonstrated robust growth, with a Compound Annual Growth Rate (CAGR) of 65.37% over the past four years. Acko has made considerable progress in the group health insurance segment, The company’s group health insurance premium surged from 119Cr INR in FY 2020-21, to 809Cr INR in FY 2023-24.

A brief look at market share & competitive position:

- Acko’s Group Health Premium represents a relatively small portion of the overall industry, accounting for just 1.47%.

- Top rankers in the group health remain: The New India Assurance Co Ltd, with a market share of 22.58%, followed by The Oriental Insurance Co Ltd at 9.50%, and ICICI Lombard General Insurance Co Ltd, holding 8.95%.

- Acko has been able to onboard over 200 new-age companies, covering more than 800,000 lives.

Acko has made several strategic moves to strengthen its position in the health and wellness space:

- Acquisition of Parentlane: A digital health platform focused on maternity and child health

- Acquisition of OneCare: Provides lifestyle care for patients with chronic diseases

Considering the fact, that Acko is merely 7 years old, its small share in the group health insurance market is bound to grow. The group health insurance segment has long been dominated by public sector health insurers in India – the reason being competitive pricing. An article by the Ken discussed this position a while back that as profitability is not the goal of PSUs, they are able to offer much more discounted pricing to corporates with lower commission rates.

Why Focus on Group Health Insurance?

Acko’s GDP share, and recent acquisitions and partnerships indicate its intention to create a comprehensive health and wellness platform. Using its full stack model, Acko wants to create a trusted environment for group health customers. Despite lower margins in group health insurance compared to retail, Acko’s focus on this segment can be attributed to:

- Customer trust building: Satisfied group policy customers are more likely to convert to retail customers. An integrated healthcare system approach allows Acko to differentiate itself in a competitive market, potentially leading to higher customer retention and lifetime value.

- Rapid topline growth and IPO focus: As corporate health insurance is small in ticket size but large in volume, insurers do use it as a tool to build their balance sheets. Acko is going for an IPO next year and a robust book in health will be the path to profitability

- Potential for cross-selling other insurance products, expanding beyond insurance products – providing services from prevention to care and recovery, in partnerships with healthcare providers (diagnostic labs, hospitals)

Future Outlook

- Acko expects health insurance to constitute 30-40% of its overall business in the next few years

- The company aims for its general insurance business, including health insurance, to be fully profitable by 2026-27

- India’s insurance sector is projected to grow at an average rate of 7.1% between 2024 and 2028

Conclusion

Acko’s strategic shift towards health insurance and its recent acquisitions clearly indicate its ambition to build a comprehensive health and wellness ecosystem for its customers. By leveraging technology, data, and strategic partnerships, Acko is positioning itself not just as an insurer but as a holistic healthcare services provider.

As Acko continues to evolve its healthcare thesis and expand its service offerings, it will be crucial to monitor how well it integrates its various acquisitions and how effectively it can cross-sell services to its growing customer base. The success of this strategy could potentially redefine the role of insurers in the broader healthcare ecosystem, setting a new standard for integrated health and wellness services in India.