After analysing the market size and growth rate of the Motor Insurance Sector in our previous article, this article focuses on the Indian Health Insurance sector in India, its key segments, its growth, and the major market players in the industry.

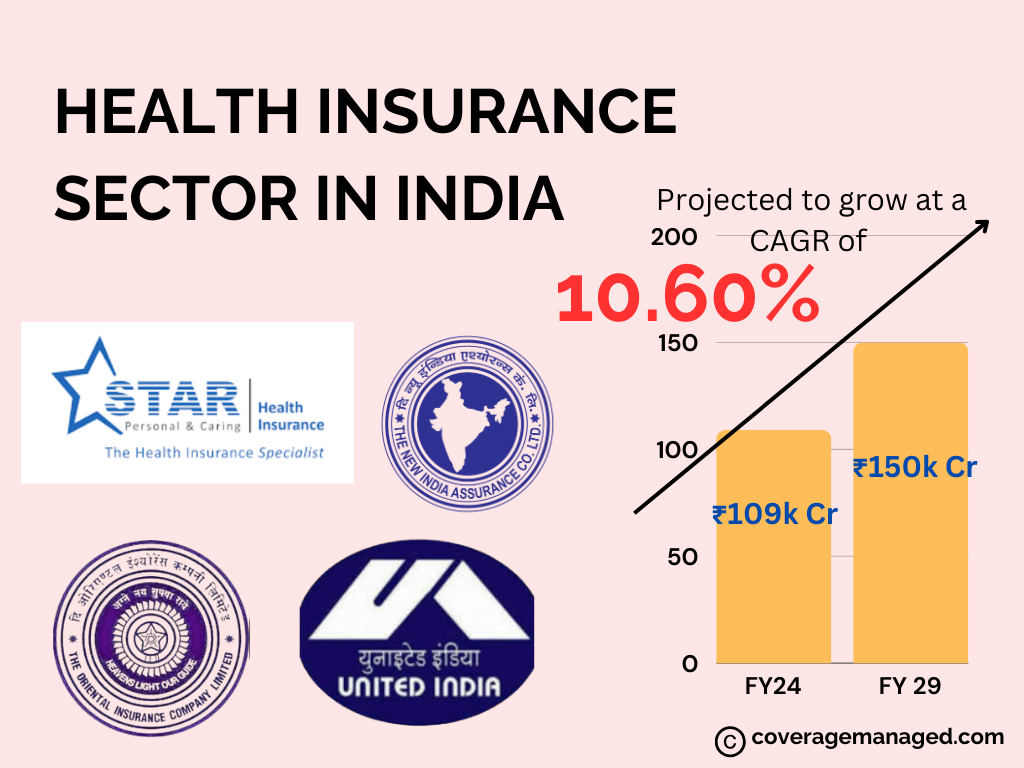

A ₹1.5 Trillion Market by 2029

The Health Insurance Sector generated INR 109k Cr in GDP (Gross Direct Premium) in FY 2023-24, with a growth rate of 19.78%. The market is expected to reach INR 150k Cr by 2029, growing at a (Compound Annual Growth Rate) CAGR of 10.60% over a 5 year period.

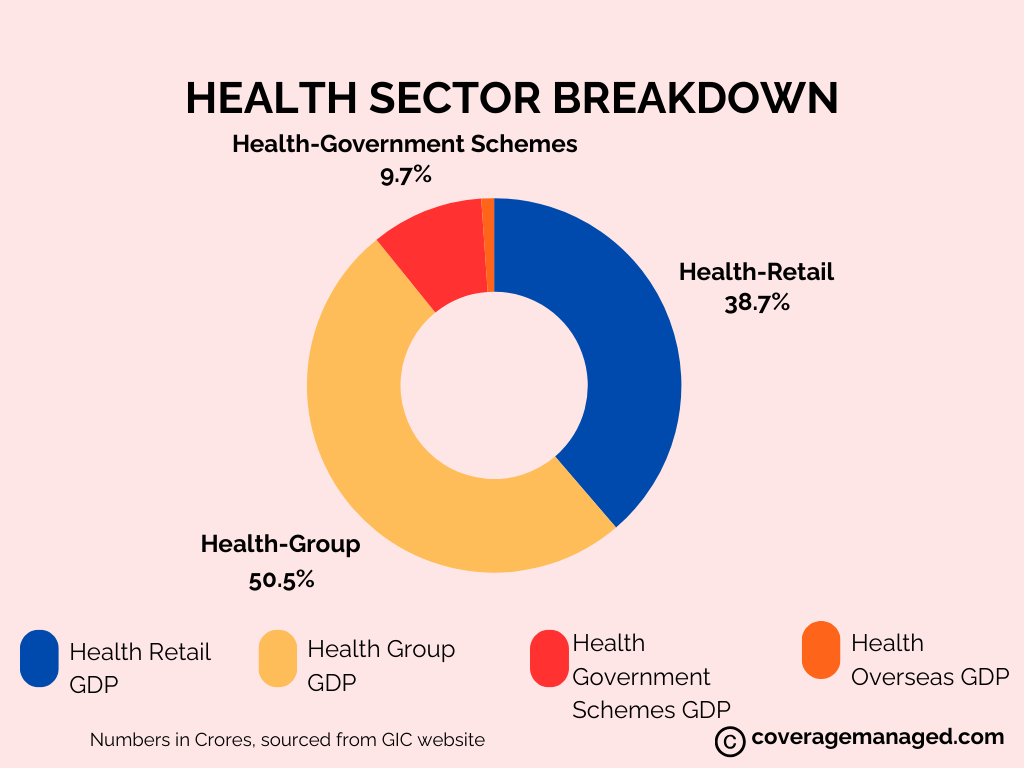

India – Types of Health Insurance Coverages

In India, the health insurance market is primarily divided between four Segments: Health Retail & Health Group. Additionally a minor portion of business also comes from Health Government Schemes, and Overseas Medical insurance. Health Retail and Health Group together account for approximately 97% of the revenue generated by the Health Insurance Sector in India.

Health Retail: These are individual insurance plans purchased directly by consumers for themselves or their families to cover future medical expenses. An example of this would be the Apollo Munich Optima Restore plan offered by HDFC Ergo.

Health Group: These are insurance coverages provided by organisations or employers to their members or employees. The Corporate Health Insurance plan provided by Star Health is one of the many such plans available in India.

Health Government Schemes: These are coverages backed by government schemes aimed at providing affordable healthcare to economically weaker sections. The Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) is a government-backed health insurance scheme.

Overseas Medical: These are coverages bought by individuals while travelling abroad to cover medical emergencies and healthcare expenses incurred while travelling. ICICI Lombard’s International Travel Insurance plan is a good example of overseas medical insurance.

2019-24, a Look into 5-Year Performance

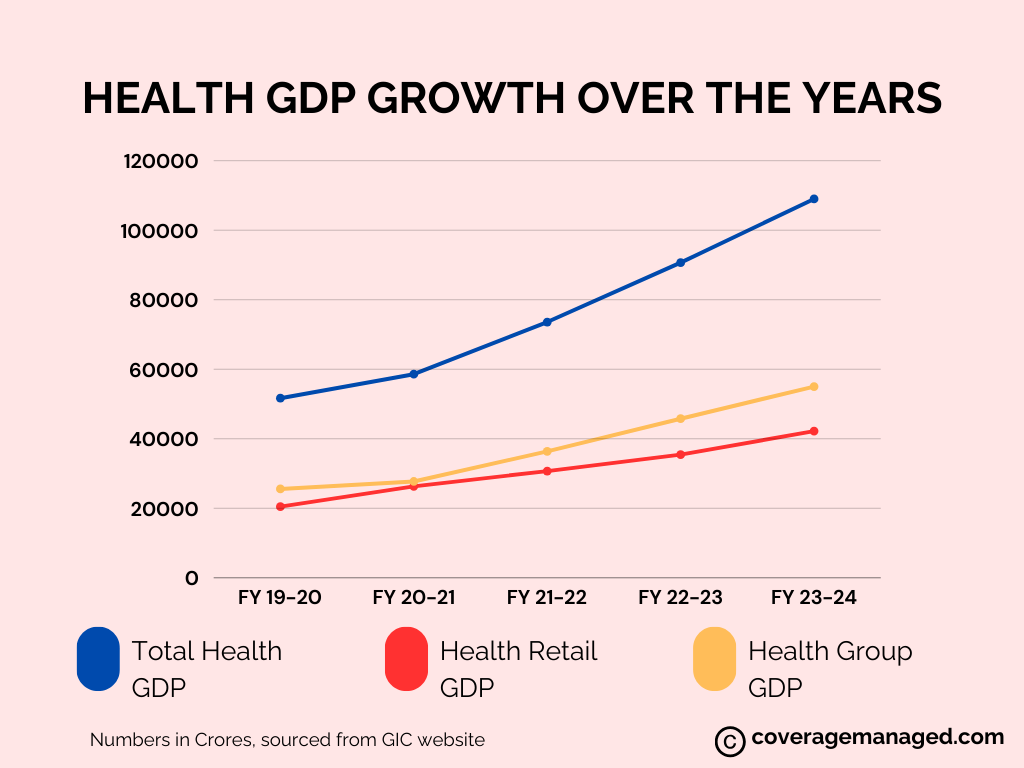

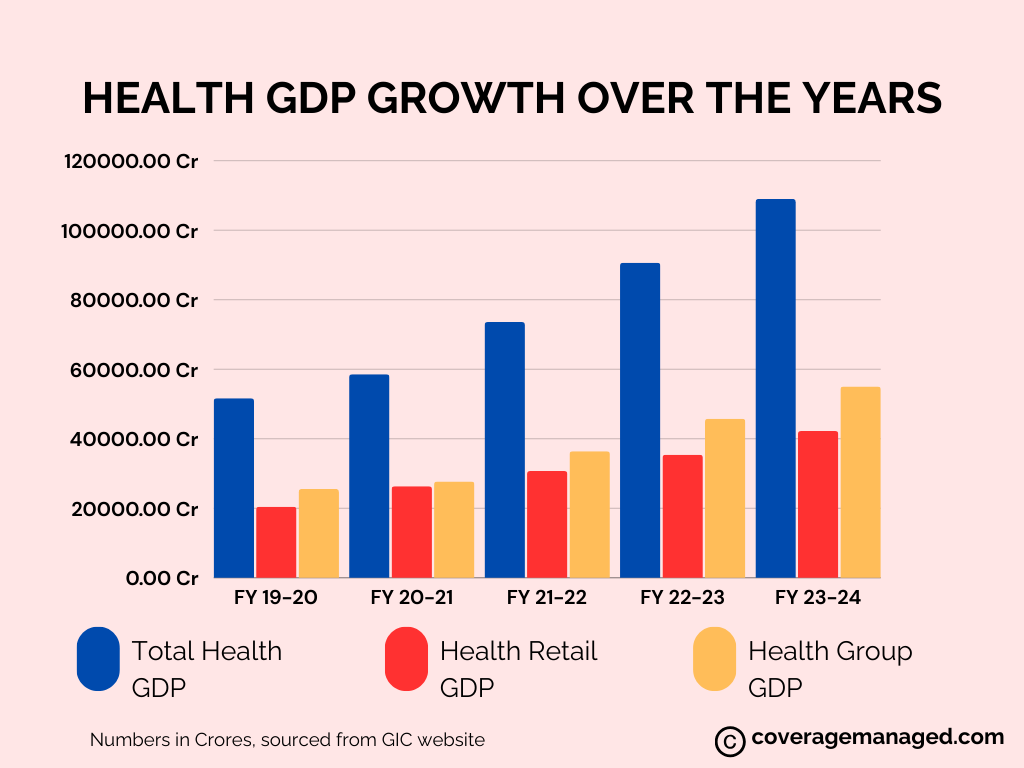

The data provided shows the GDP of the Health Insurance sector in India for the FY 2019-20 to 2023-24. The data is broken down into three components: Total Health GDP, Health Retail GDP, and Health Group GDP. This period is also crucial for assessing the growth of the Indian Health Insurance market and understanding the way it’s heading.

Here are some key observations on how Health Insurance GDP has performed in the last 5 years:

Total Health: The Total Health GDP has considerably increased over the past five years, from INR 51k Cr in FY 19-20 to INR 109k Cr in FY 23-24. This represents a CAGR of 16.10% for the 5 year period.

Health Retail GDP: The Health Retail GDP has significantly increased over the past five years, from INR 20k Cr in FY 19-20 to INR 42 Cr in FY 23-24. This represents a CAGR of 15.57% for the 5 year period.

Health Group GDP: The Health Group GDP has increased even more over the past five years, from INR 25k Cr in FY 19-20 to INR 55k Cr in FY 23-24. This represents a CAGR of 16.57% for the 5 year period.

From this data, it is very evident that the Health Insurance Sector in India has witnessed immense growth over the past half a decade.

TOP 5 INSURERS

The leading players in the market are The New India Assurance Co Ltd followed by Star Health & Allied Insurance Co Ltd, both of which generate a GDP nearly twice that of their nearest competitors. The New India Assurance Co Ltd is a public sector company, whereas Star Health & Allied Insurance Co Ltd. is a private sector company.

Star Health & Allied Insurance Co Ltd stands to be the only private sector company amongst the top five insurers in the Health Insurance Sector.

To get a better understanding of the standings of the private players, let’s keep the public sector companies aside and look at the top five health insurers from the private sector.

TOP 5 INSURERS (PRIVATE SECTOR)

Within the private players, Star Health & Allied Insurance Co Ltd is the most dominant health insurer with a total GDP of 15.04 thousand Cr, which is about 2.2 times the total GDP of its closest competitor. Health Retail is Star Health’s biggest portfolio, contributing 13.95 thousand Cr to its total GDP, followed by Health Group with 1.08 thousand Cr and Overseas Medical with 0.005 thousand Cr.

Although Star Health generates the highest combined GDP, it is not a market leader for each of the segments, this warrants a closer look at each segment, particularly Health Retail and Health Group to identify the top five insurers for each of them.

A closer look at the top 5 five insurers, particularly comparing the top three in Health Retail and Health Group, provides some interesting insights. The overall leader in the insurance sector, New India Assurance Co Ltd primarily generates its revenue through Health Group schemes, it forms 67.8% of its total GDP. Similarly, for the biggest private sector player, Star Health, Health Retail forms 92.7% of its total GDP.

These observations indicate that market capitalisation in a particular segment leads to a better overall position in the market rather than adopting a broader approach.

Conclusion

The health insurance sector in India is growing at a faster pace than the motor insurance sector, showing strong resilience depsite challenges like COVID-19. With a projected market size of ₹1.5 trillion by 2029 and a healthy growth rate of 10.60% annually, the future looks bright. Some companies, like Star Health and New India Assurance, have smartly focused on specific segments, giving them a significant edge in the market. Despite the pandemic, the sector performed well, which is a clear sign of its strength and potential. It’s definitely a space to watch, as continued growth and focused strategies will likely shape the market’s future success.