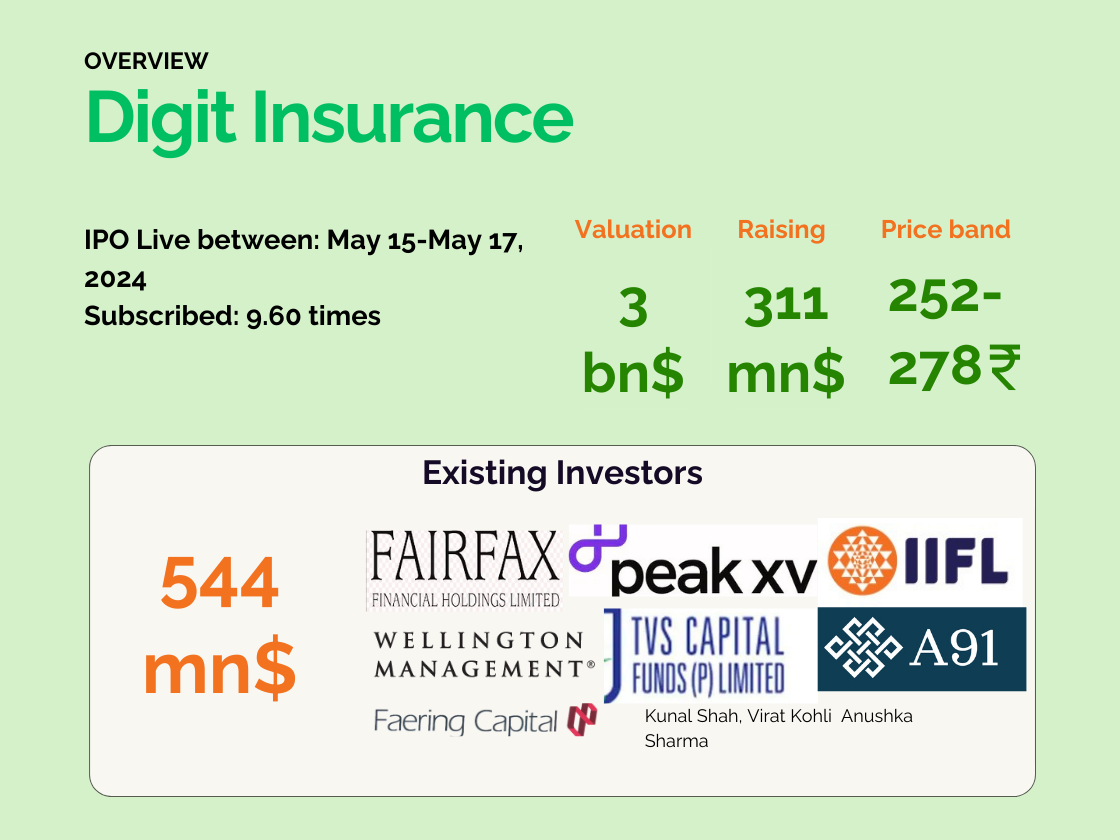

Digit Insurance recently concluded its Initial Public Offering (IPO) between May 15 and May 17, 2024. The IPO was a significant success, being oversubscribed 9.60 times, and raised a substantial amount of USD 311 million, with the shares ranging in the price band of INR 252 to INR 278. The company’s valuation stands at USD 3 billion.

Digit Insurance continues to grow with the backing of notable investors such as Fairfax Financial Holdings Limited, Peak XV, IIFL, Wellington Management, TVS Capital Funds (P) Limited, A91, Faering Capital, and individuals Kunal Shah, Virat Kohli, and Anushka Sharma. This support was also pivotal during the Digit Insurance IPO.

Financial Metrics for Fiscal year 2023-2024

Digit Insurance achieved a Gross Written Premium (GWP) of INR 9,016 crore during FY 23-24, representing a market share of 3.1%. This was a great milestone following the recent IPO of Digit Insurance.

Digit Insurance’s Gross Written Premium is segmented into four main lines of business:

- Motor Insurance is the major contributor accounting for 61% of the GWP.

- Health Insurance, overseas & PA accounts for 19%,

- Fire Insurance accounts for 9% and

- the remaining 11% is made up by Other Insurance segments.

Distribution Channels

Digit Insurance utilises a diverse set of distribution channels to reach its customers. These distribution channels are divided between brokers who are the biggest contributors with a 62.4% share to the GWP, followed by Individual agents with a share of 19%, followed by Point of Sales Persons at 11.6% and Corporate agents at 4.4%, and others at 2.6%. The strength and coverage of these channels significantly contributed to the oversubscription of the Digit Insurance IPO.

Consumer Base and Financial Health

Digit Insurance serves a large customer base with 4.7Cr customers and has issued 1.1 Cr policies. The company offers 77 active products, with manual policy issuance accounting for only 0.33%. Their extensive consumer base also added to the success of the recent IPO of Digit Insurance.

Digit Insurance’s financial ratios indicate positive financial health of the company.

The Way Forward for Digit

After a successful IPO the company has further solidified its position in the Indian insurance market. As the company moves forward, it has an opportunity to expand its product offerings and enhance customer experience through innovation and technology, continuing to build on the momentum created by the Digit Insurance IPO.

*An updated version of the article was posted on 10-09-24