The three major segments in insurance in India remain – health, life & auto/motor. Motor insurance generated 91.8Cr INR (12.24bn$) in GDP (Gross Direct Premium) in FY23-24. The GDP grew at a CAGR of 12.92% in the FY 23-24. In the article below, I look at the India motor insurance market growth over a 5 years period.

A 19.48bn$ market by 2029

Motor insurance in India is projected to grow at a CAGR of 10.25% for the period 2024-29. A research by Mordor Intelligence has calculated the CAGR in terms of GWP (ie, Gross Written Premiums). The GWP volume is supposed to grow from 11.96bn$ to 19.48bn$ by 2029. This showcases the India motor insurance market growth potential.

GDP v GWP

GWP includes both direct & assumed premium (premium from reinsurance cessions) written by an insurer while GDP refers to the direct premium written by the Insurer. (Updated) Based on my understanding of GDP & GWP, GWP is the preferred metric for calculating growth of insurance. However, the data is not publicly accessible at all times, so wherever the data is not available we will refer to the GDP numbers to discuss India motor insurance market growth.

India – kind of motor Insurance Coverages

In India, auto/motor insurance business includes:

- Motor TP business: Motor third party liability, is a mandatory coverage under the Motor Vehicles Act 1988. A vehicle in India cannot ply on road without an adequate motor TP coverage, which will include accidents, etc causing injury/death of a passerby. A critical aspect of India’s motor insurance market growth.

- Motor OD component: Motor own damage includes coverage against damage to the automobile insured, theft, etc.

A regulatory post under the IRDAI framework will cover more details on the above.

2019-24, a look into 5 year performance

The data provided shows the GDP of the auto/motor insurance sector in India for the FY 2019-20 to 2023-24. The data is broken down into three components: Total Motor GDP, Motor Own Damage (OD) GDP, and Motor Third-Party (TP) GDP. At the end of March ‘24, the Gross Direct Premium of motor insurance sector was 91.8Cr INR (12.24bn$). I have refrained from converting the data from INR to $ to avoid conversion rate related discrepancies in a 5 year timeline. This period is crucial in evaluating the India motor insurance market growth.

Here are some key observations on how motor insurance GDP has performed in the last 5 years:

- Total Motor GDP: The Total Motor GDP has steadily increased over the past five years, from 67.8Cr INR in FY 19-20 to 91.8Cr INR in FY 23-24. This represents a CAGR of 6.25% for the 5 year period.

- Motor OD GDP: The Motor OD GDP has also increased over the past five years, from 26Cr INR in FY 19-20 to 37.3 INR in FY 23-24. This represents a CAGR of 7.45% for the 5 year period.

- Motor TP GDP: The Motor TP GDP has increased over the past five years, from 41.7Cr INR in FY 19-20 to 54.5Cr INR in FY 23-24. This represents a CAGR of 5.48% for the 5 year period. Clearly, the India motor insurance market growth is evident.

Top 5 Insurers in Motor Insurance Segment

- The market is dominated by ICICI Lombard & New India – a public sector insurer. There are four public sector general insurance companies in India (GOI is the dominating shareholder) – New India Assurance Company Limited, United India Insurance Company Limited, Oriental Insurance Company Limited, National Insurance Company Limited.

- We will keep public sector insurance companies out of this discussion for now. Focusing on the top 5 private sector insurance companies:

- ICICI Lombard’s Dominance: ICICI Lombard leads the pack with the highest Total Motor GDP, Motor OD GDP, and Motor TP GDP. If we talk about numbers, ICICI Lombard motor total GDP is 9.6Cr INR, with Motor TP being 4.7Cr INR & Motor OD being 4.9Cr INR. It has 10.5% market share in the total motor insurance premium earned by the sector.

- The difference in the GDP numbers between ICICI Lombard & the second ranker TATA AIG (motor total at 7.4Cr INR) of around 2kCr INR in premium numbers show the market dominance of ICICI Lombard amongst all other market players. In our next article, we will look closely at ICICI Lombard’s business model to understand its dominance better. This will highlight important factors of India motor insurance market growth.

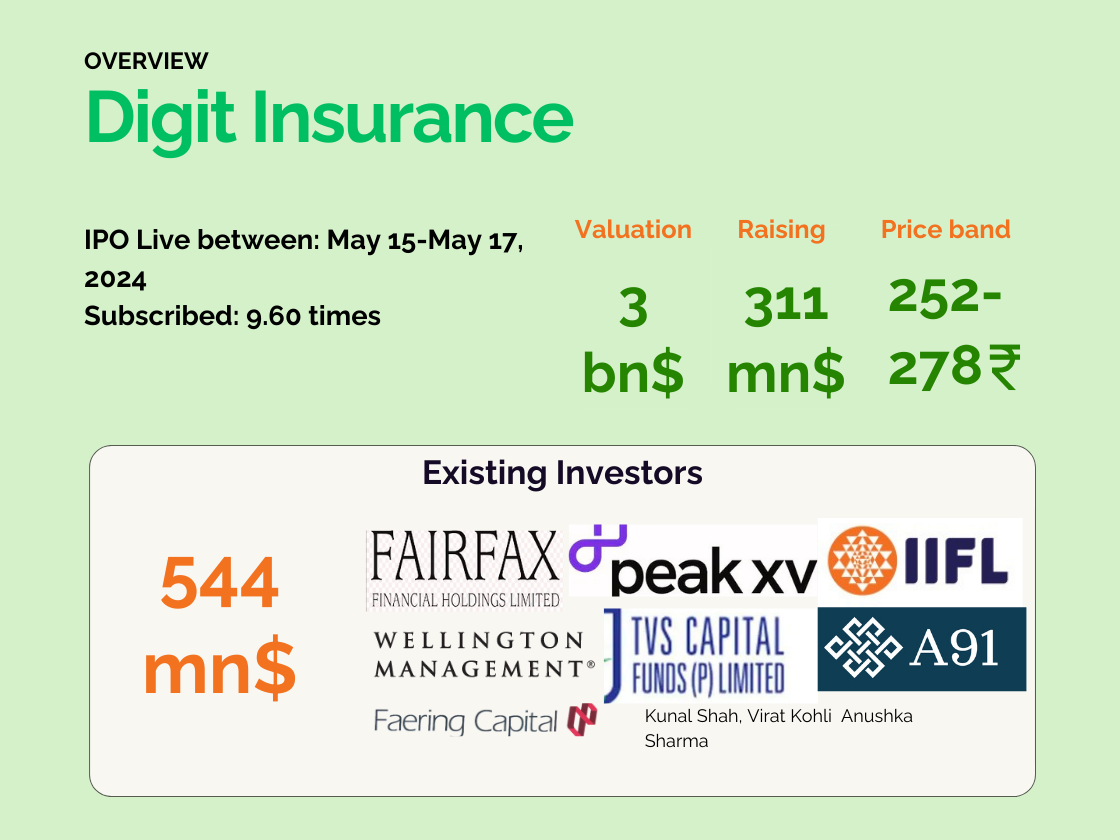

- Growth Potential: The presence of newer players like GoDigit and HDFC Ergo indicates a competitive market with opportunities for growth.

Conclusion

India’s motor insurance market is a dynamic and rapidly evolving sector, offering significant opportunities for growth and investment. With a growing vehicle population and rising awareness of insurance coverage, the market is poised for further expansion. By understanding the key trends, market leaders, and growth potential, insurers and investors can position themselves for success in this thriving industry. Overall, the India motor insurance market growth story is one to watch.